Tobacco Use, “Deaths of Despair”, and Widening Inequality in Life Expectancy in the United States

Patricio V Marquez

February 2023

“Lifting a person's vision to higher sights is the raising of a person's performance to a higher standard.”

Peter F. Drucker

There is substantial concern in the United States (U.S.) today about growing income inequality and the dramatic increase in life expectancy inequality. As discussed below, tobacco use plays an important role in these disparities.

In their 2020 book, “Deaths of Despair”, Princeton University professors Anne Case and August Deaton (winner of the 2015 Nobel Prize in Economics) provide a groundbreaking account of the recent fall of life expectancy in the U.S.—a reversal not seen in any other wealthy country in modern times. Since 2010, life expectancy gains have been among the slowest on record for the U.S., declining for three consecutive years over 2014-2017, when an opioid epidemic took hold. Between 2010 and 2018, life expectancy increased by less than a tenth of a year. More recent data from the CDC’s National Center for Health Statistics, that takes into account the impact of excess deaths due to COVID-19 and other causes, show that life expectancy at birth declined nearly a year from 2020 to 2021 – from 77.0 to 76.1 years –, the lowest level since 1996. The 0.9 year drop in life expectancy in 2021, along with a 1.8 year drop in 2020, was the biggest two-year decline in life expectancy since 1921-1923. The overall decline in life expectancy between 2019 and 2021, was 3.1 years for males and 2.3 years for females.

Considerable geographic, racial, ethnic, and gender variation underlies national-level trends in life expectancy. In 2015–2019, residents in metropolitan areas had higher life expectancies than people living in nonmetropolitan areas and specific regions, such as rural areas and the South and Appalachia regions, (79.6 years compared to 77.0 years).

Although there have long been racial and ethnic disparities in life expectancy, the gaps had been narrowing in recent decades. For example, the African-American–White life expectancy gap fell 48.9% over 1990-2018. Covid-19, however, did away with much of that progress, disproportionately affecting minority populations, who were more likely to be employed in risky, public-facing jobs during the pandemic — bus drivers, restaurant cooks, sanitation workers — rather than working from their homes. Increases in excess deaths led to a decline in life expectancy between 2019 and 2021 of 6.6 years among Native Americans and Alaska Natives, 4.2 years for Hispanics, 4.0 years for African-Americans, compared to 2.4 years for Whites and 2.1 years for Asian-Americans.

While it is long documented that life expectancy is lower for individuals with lower socioeconomic status (SES) compared with individuals with higher SES, recent studies provide evidence that this gap has widened in recent decades. A 2015 study by the National Academy of Sciences found that for men born in 1930, individuals in the highest income quintile (top 20%) could expect to live 5.1 years longer at age 50 than men in the lowest income quintile, and among men born in 1960, those in the top income quintile could expect to live 12.7 years longer at age 50 than men in the bottom income quintile. This study finds similar widening patterns for women: the life expectancy gap at age 50 between the bottom and top income quintiles of women expanded from 3.9 years for the 1930 birth cohort to 13.6 years for the 1960 birth cohort.

Findings from another study offer a more nuanced explanation by suggesting that the association between life expectancy and income not only varied substantially across geographic areas, but that the differences were correlated with health behaviors and local area socioeconomic and demographic characteristics, especially education, income, and race. For example, Professors Case and Deaton documented in their book a marked increase after 1998 in the all-cause mortality among middle-aged white men and women with low levels of education, that is largely accounted for by increasing death rates from accidental opioid overdoses, alcoholic liver disease, and suicide. The pandemic appears to have amplified the opioid crisis, with the majority of U.S. states reporting increases in opioid-related deaths.

Tobacco Use Contributes to Life Expectancy Inequality in the U.S.

Although cigarette smoking has declined over the past several decades in the U.S., yet nearly one in five adults continued to use combustible and noncombustible tobacco products according to data from the 2020 National Health Interview Survey (NHIS).

Among U.S. adults in 2020, 19.0% (estimated 47.1 million) currently used any tobacco product, 15.2% (37.5 million) used any combustible tobacco product, and 3.3% (8.1 million) used two or more tobacco products. Cigarettes were the most commonly used tobacco product (12.5%; 30.8 million), followed by e-cigarettes (3.7%), cigars (3.5%), smokeless tobacco (2.3%), and pipes (1.1%). From 2019 to 2020, the prevalence of overall tobacco product use, combustible tobacco product use, cigarettes, e-cigarettes, and use of two or more tobacco products decreased.

However, certain parts of the country and populations continue to smoke at high rates, highlighting uneven progress in preventing and reducing tobacco use. Adults that live in rural areas smoke at a rate of 19.0% compared to 11.4% among adults that live in cities. Adults in rural areas are also more likely to smoke heavily (i.e., 15 or more cigarettes per day), compared to those who smoke and live in cities.

Educational disparities in smoking have worsened over time in the U.S. Findings from a recent study revealed that lower educational attainment was associated with increased ever and current smoking prevalence over time across all racial/ethnic groups, and education-level disparities within each race/ethnicity widened over time. Disparities in ever and current smoking rates between the lowest and highest categories of educational attainment (less than a high school education vs. completion of college) were larger for African-Americans and Whites than Hispanics/Latinos. Non-Hispanic Whites had the highest cigarette consumption across all education levels over time. College graduates had the highest quit ratios for all racial/ethnic groups from 1992 to 2018.

Tobacco use is the leading cause of preventable disease, disability, and death. Cigarette smoking causes about one of every five deaths in the U.S. each year. Annually, nearly half a million people die prematurely of smoking or exposure to secondhand smoke, a number that is equal to about one-half of the total combined reported deaths from COVID-19 in the U.S. since the beginning of the pandemic. Another 16 million live with a serious illness caused by smoking. During the pandemic, strong evidence was also found that tobacco use increased risks of mortality and disease severity/progression among COVID-19 patients.

Overall, findings from a study done by Jha et al., show that among participants 25 to 79 years of age who were interviewed in the U.S. National Health Interview Survey (NHIS) between 1997 and 2004, and related these data to the causes of deaths that occurred by December 31, 2006, life expectancy was shortened by more than 10 years among the current smokers, as compared with those who had never smoked. Most of the excess mortality among smokers was due to neoplastic, vascular, respiratory, and other diseases that can be caused by smoking.

Increasing geographic inequalities in mortality in the U.S. are partly due to geographic divergences in smoking patterns over the past several decades. The gap in life expectancy between metropolitan and nonmetropolitan areas, particularly in rural areas of the South and Midwest regions, increased by 2.17 years for men, and 19% of that increase was due to smoking, and for women, increased by 2.77 years, and 22% of that increase was due to smoking, over 1990 and 2019.

Smoking has also been responsible for a substantial portion of deaths across sex and race groups, with African-American men consistently having the highest proportion of deaths due to smoking. This outcome confirms continuing mortality differentials in the U.S. due to previous smoking exposure, especially among African-American who have disproportionately used menthol cigarettes. It is estimated that among men, smoking-attributable mortality caused almost 28% of the reduction in the difference in life expectancy at age 50 for African-Americans compared to Whites in 2000 and approximately 15% of the reduction in 2019. Among women the contribution of smoking to differences in mortality and life expectancy by race was somewhat smaller during the same period.

During a 2016 presentation at the World Bank, Jason Furman, the former Chairman of the Council of Economic Advisers during the Obama Administration, noted that differing trends in smoking rates by income in the U.S. are likely one important factor driving differences in the evolution of mortality rates among people in different income groups as lower-income individuals are more likely to experience higher rates of smoking-related disease and death. While adult smoking rates have dropped from 25.5% in 1990 to an estimated 13.9% in 2017, lower-income individuals have not seen as large a drop in smoking rates. In 2016, 25.3% of adults living below the poverty level smoked, compared with 14.3% of adults living at or above the poverty level. People living in poverty smoke cigarettes more heavily and smoke for nearly twice as many years as people with a family income three times the poverty rate. As a result, they suffer more from smoking-caused diseases. People living below the poverty level also have higher levels of exposure to secondhand smoke. In 2017-2018, 44.6% of people living below the poverty level were exposed to secondhand smoke, compared to 21.3% of people living at or above the poverty level.

Although the impact of cigarette smoking on mortality is diminishing in the U.S., new tobacco products aimed at youth are on the market. According to the 2020 National Youth Tobacco Survey, current use of any tobacco product was reported by 16.2% (4.47 million) of all students, including 23.6% (3.65 million) of high school (grades 9-12) and 6.7% (800,000) of middle school (grades 6-8) students. Electronic cigarettes (e-cigarettes) were the most commonly used tobacco product among high school (19.6%; 3.02 million) and middle school (4.7%; 550,000) students. Given their relatively recent introduction, the long-term health impacts of e-cigarette use are not yet well-established. But, growing evidence suggests that vaping might serve as an introductory product for preteens and teens who then go on to use other nicotine products, including cigarettes, which are known to cause disease and premature death. Additionally, a study of adult smokers in Europe found those who vaped nicotine were less like to have stopped smoking than those who did not, and those who used e-cigarettes also smoked more cigarettes than those who did not. Another study of some e-cigarette products found the vapor contains known carcinogens and toxic chemicals, as well as potentially toxic metal nanoparticles from the device itself.

Smoking Costs the U.S. Billions of Dollars Each Year

Estimates show that cigarette smoking cost the U.S. more than $600 billion in 2018, as follows:

- More than $240 billion in healthcare spending, including by federal government programs (e.g., Medicare, VA health care) and federal and state programs (e.g., Medicaid) that are funded by taxpayers.

- Nearly $185 billion in morbidity-related productivity losses attributable to cigarette smoking. Absenteeism, presenteeism, home productivity, and the inability to work accounted for $9.4 billion, $46.8 billion, $12.8 billion, and $116.0 billion, respectively. State-level total costs ranged from $291 million to $16.9 billion, with a median cost of $2.7 billion.

- Nearly $180 billion in lost productivity from smoking-related premature death.

- $7 billion in lost productivity from premature death from secondhand smoke exposure.

Lost earnings due to smoking-attributable deaths are substantial in the U.S. and are highest in states with weaker tobacco control policies. For example, in 2019, the estimated person-years of life lost (PYLL) and lost earnings due to cigarette smoking-attributable cancer deaths among individuals aged 25 to 79 years in 2019, were 2 188 195 PYLL and $20.9 billion, respectively. States with the highest overall age-standardized PYLL and lost earning rates generally were in the South and Midwest.

Can Investing in the Tobacco Industry be an Ethical Investment?

In recent years, the performance of the tobacco industry has been impacted by a significant decline in tobacco consumption. In large measure, this development has been the result of the adoption of stringent regulatory and taxation policies, as well as higher awareness among the population of the health risks associated with smoking. In the U.S., as reported by the Federal Trade Commission (FTC), the tobacco industry has been experiencing an annual downward trend in sales since 2000, when sales volume to wholesalers and retailers was at 413.9 billion cigarettes, before dropping 202.9 billion in 2019. In 2020, sales increased by 0.4% from 2019, the first increase in cigarettes sold in 20 years, but decreased from 203.7 billion in 2020 to 190.2 billion in 2021. Also, the U.S. FTC data show smokeless tobacco sales decreased from 128.4 million pounds in 2018 to 126.0 million pounds in 2019, rebounding to only 126.9 million pounds in 2020, and decreasing from 126.8 million pounds in 2020 to 122 million pounds in 2021.

The downward trajectory experienced by the tobacco industry, is clearly illustrated by 2022 data from one of the Big Tobacco companies that show:

- “Smokeable products segment reported domestic cigarette shipment volume decreased 9.7%, primarily driven by the industry’s decline rate and retail share losses”

- When adjusted for calendar differences and trade inventory movements, smokeable products segment domestic cigarette shipment volume decreased by an estimated 9.5%.

- When adjusted for trade inventory movements, calendar differences and other factors, total estimated domestic cigarette industry volume decreased by an estimated 8%.

- Reported cigar shipment volume decreased 4.0%.”

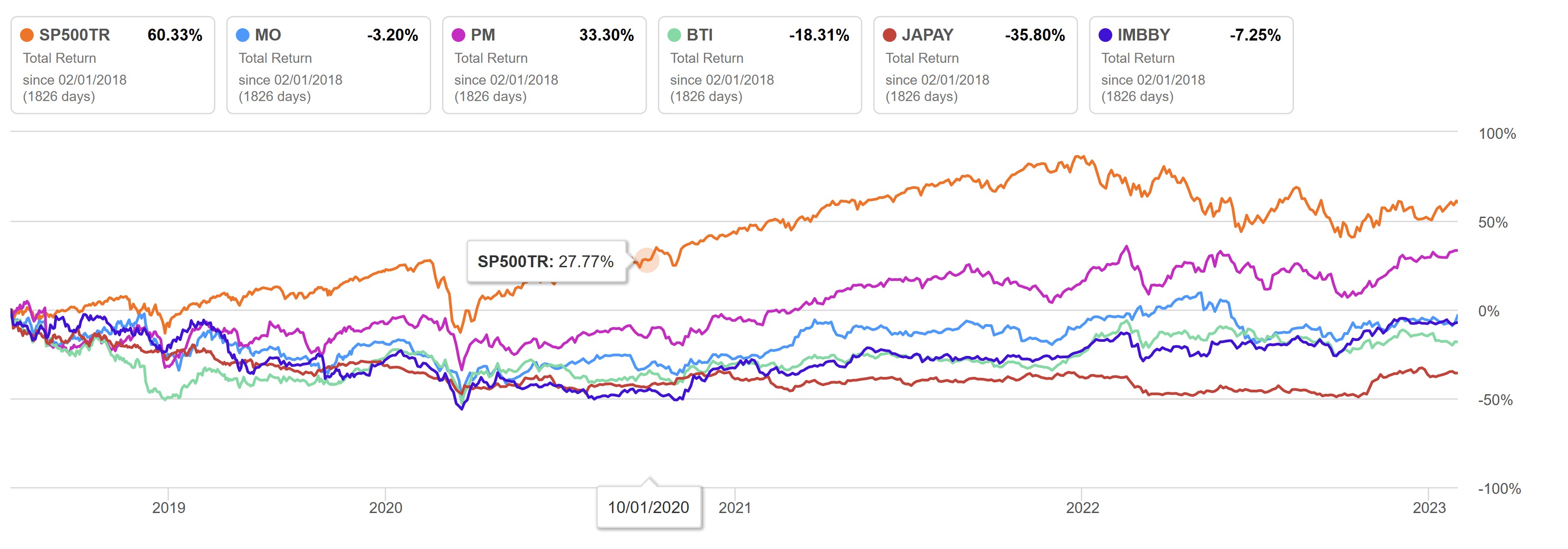

Overall, as shown in Figure 1, the comparative total return (includes interest, capital gains, dividends, and distributions realized over a period) of Tobacco companies vs S&P500 companies for the past five years through early 2023 is not positive. With the exception of one company, the tobacco industry shows negative performance, compared to the S&P500 companies.

Figure 1: Lower Total Return of Tobacco Companies vs S&P500 Other Industries (in orange)

Source: https://seekingalpha.com/symbol/SP500-302030/charting?interval=5Y

In this context, the question posed in a recent Wall Street Journal article about whether investing in the tobacco industry is an ethical investment is not only appropriate but highly relevant for discussing socioeconomic and demographic challenges facing the country.

Hoping to improve its “toxic reputation with investors”, tobacco companies have announced the setting of new targets to shift to e-cigarettes away from cigarettes. However, there exists much skepticism about the industry’s transition claim. At the heart of the skepticism is the cold fact that the same tobacco industry which promotes e-cigarettes, as a ‘harm reduction’ product to replace cigarettes and “unsmoke the world”, continues to derive the bulk of its profits by promoting and selling cigarettes in low- and middle-income countries, where about 80% of the world’s smokers now live, tapping fast growing young populations, rising per capita incomes, weak governance systems, lax regulatory environments, and low tobacco taxation levels.

More ominous to the industry are signs of a shrinking pool of investors willing to buy tobacco industry shares. According to the Wall Street Journal (WSJ) article, this trend is illustrated by Bank of America data that show that select stocks based on environmental, social and governance (ESG) criteria attracted inflows of $194 billion in 2020, while Philip Morris and Marlboro’s U.S. manufacturer Altria are the second- and third-most underweighted stocks in ESG portfolios relative to their weighting in the S&P 500 index. The E in ESG, environmental criteria, includes the energy companies takes in and the waste it discharges, the resources it needs, and the consequences for living beings as a result. S, social criteria, addresses the relationships a company has and the reputation it fosters with people and institutions in the communities where it does business. G, governance, is the internal system of practices, controls, and procedures a company adopts in order to govern itself, make effective decisions, comply with the law, and meet the needs of external stakeholders. The WSJ article also notes that even tobacco companies’ generous payouts were not enough of a lure to investors--Philip Morris and Altria have dividend yields of 5.7% and 8.2%, respectively, compared with 1.5% for the S&P 500.

Excluding Tobacco from Investment Portfolios Can Help Arrest Mortality Inequalities in the U.S.

Given the toll of disability and premature death that the tobacco industry has caused and continues to cause in the U.S., excluding tobacco from investment portfolios is an ethical duty for institutional and individual investors. It also a sound financial decision given mounting regulatory and fiscal pressure, and raising awareness of the population about the health and environmental risks posed by tobacco use, that further impact the value of tobacco investments accelerating their downward trajectory.

Indeed, recent regulatory measures adopted by the U.S. Government bode ill to the future of the tobacco industry. In mid-2023, for example, the U.S. Food and Drug Administration (FDA) issued marketing denial orders for two menthol e-cigarette products currently marketed by R.J. Reynolds Vapor Company. The currently marketed products include the Vuse Vibe Tank Menthol 3.0% and the Vuse Ciro Cartridge Menthol 1.5%. This implies that the company must not market or distribute these products in the U.S. or they risk FDA enforcement action.

The tobacco companies’ own claims about lower health risks associated with e-cigarettes have been further undermined by legal action. The announcement by the Attorney General of Connecticut, along with 34 states and territories in the U.S. on September 6, 2022, in reaching a landmark US$438.5 million agreement with JUUL Labs (until recently, the dominant player in the vaping market) that will end its advertising campaigns that relentlessly marketed vaping products to underage youth, manipulated their chemical composition to be palatable to inexperienced users, employed an inadequate age verification process, and misled consumers about the nicotine content and addictiveness of its products, will likely steer many investors further away from the tobacco industry.

As finance sector actors wield enormous power worldwide with their investment, lending, and insurance decisions, their active engagement can be a game-changing possibility for tobacco control. Indeed, institutional and individual investors ditching tobacco stocks over ESG concerns, and “voting with their wallets” towards tobacco-free investments, can have a major impact in reducing health risks and preventable deaths from tobacco-attributable diseases, helping arrest the drop in life expectancy, while contributing to the achievement of net zero environmental targets.

More importantly, at the macro- economic level, longer, healthier lives, free of tobacco-attributable diseases and disability, can help secure the highest return on human capital, contributing to economic growth and wealth creation, boosting employment and incomes, productivity, and competitiveness, while reducing the fiscal burden of increased health expenditures and the negative impact of tobacco on the environment. Previous health improvements have been positive for the economy; the task now is to achieve the same outcome for the well-being of the entire population in the U.S.

The Tobacco-Free Finance Pledge, a global initiative with a mission to inform, prioritize, and advance tobacco-free finance with the end goal being a world free from tobacco, is a promising and innovative approach to firm up U.S. investors’ decisions. The uptake of this initiative in the United States and globally will complement and further maximize the impact of the regulatory and fiscal policies codified in the WHO Framework Convention on Tobacco Control (FCTC). While taxes and cutting back investment in the tobacco industry are separable, including in political economy, these measures would strongly reinforce each other.

The Pledge has already been signed by almost 200 investors globally, representing over $16 trillion in assets under management. If more U.S. investors sign The Pledge and realize their commitment to exclude tobacco from investment portfolios as an integral part of business strategy and management, more will be motivated by the power of their example to embrace The Pledge and to make an impactful difference in the short-and long-terms.

While the Pledge focuses on tobacco, it intersects with and compliments many other important environmental initiatives, relating to ocean health, biodiversity, and deforestation, as well as to global public health initiatives such as the universal health coverage agenda and pandemic preparedness and response.

Considering the opportunity cost of capital, investors can still earn an equity premium without investing in tobacco stocks and risking reputational damage, or to be involved in multi-million legal disputes. This realization would help reduce the attractiveness of the investing in the tobacco industry. More importantly, investors can use their capital and influence to invest in a sustainable future helping reverse the decline of life expectancy and prevent further environmental degradation.

Indeed, as observed by Columbia University Professor, Bruce Usher, author of the book "Investing in the Era of Climate Change",

“The actions that investors take over the next few decades are going to change the planet…. How they go about doing that, how quickly that capital is invested and how effectively it’s invested is going to make all the difference…. The reality is that the capital exists, but mobilizing and investing that capital is a pretty significant challenge. In the context of many of the other great challenges that society faces, we actually have at hand the ability to solve this one”.

In doing so, paraphrasing Peter Drucker, the father of modern business management theory, business leaders will be embracing the “spirit of performance” by displaying high levels of moral and ethical integrity in their actions, focusing on results, empowering employees, going beyond financial obligations to shareholders, and ultimately serving the common good.

Source of Image: /www.shutterstock.com. "Demographic decline", #2247748385