A Perspective: Decoding the Tobacco Industry’s “Unsmoke the World” Claim

Patricio V. Marquez

Background

There exists much skepticism about the tobacco industry’s claim that it wants to “unsmoke the world”.[1] Tobacco control proponents question how much the tobacco industry’s “transition narrative” should be trusted. [2] The history of the tobacco industry provides ample evidence for skepticism, if not outright rejection. While scientific studies demonstrated the negative harms of tobacco use, the tobacco industry engineered a decades-long campaign of scientific disinformation to delay, disrupt, and suppress these studies, as documented by Harvard University historian Allan Brandt.[3]

At the heart of this skepticism is the cold fact that the same tobacco industry which promotes e-cigarettes,[4] as a ‘harm reduction’ product to replace cigarettes and “unsmoke the world”, continues to derive the bulk of its profits by selling cigarettes. Perhaps, it may be inferred, as pointed out in a Financial Times article, that this “reduced-risk business model relies on there being smokers to convert”.[5]

1. A Fading Industry: Declines in Consumption and Financial Underperformance

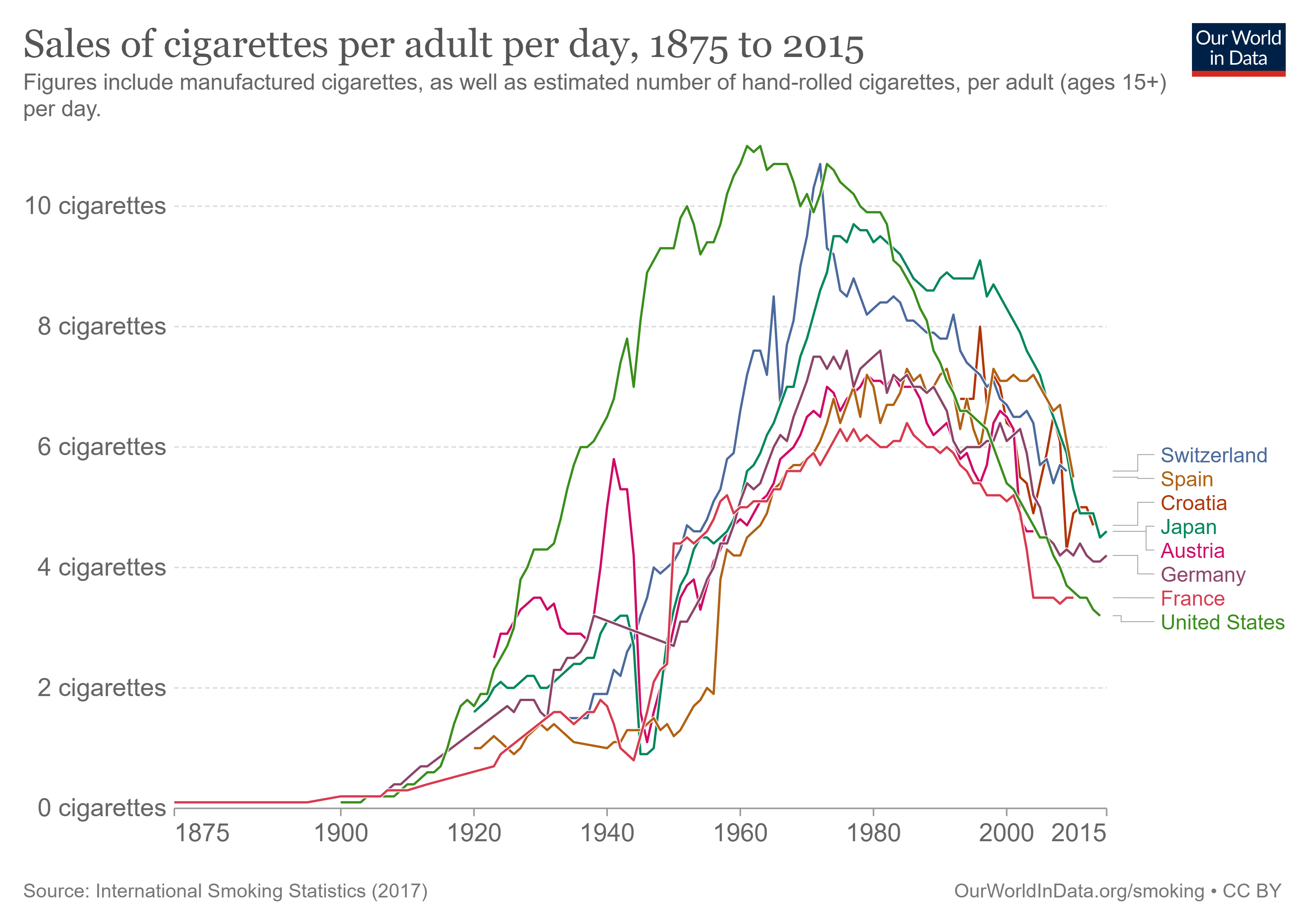

Over the past decade, the financial performance of the tobacco industry has been impacted by a significant decline in cigarette consumption, particularly in high-income countries. In large measure, this resulted from the adoption by governments of stringent regulatory and taxation policies to control tobacco use, and higher awareness among the population about its health risks. The figure below shows that the decrease in the average number of cigarettes sold per adult per day in high-income countries followed a similar trajectory: a steep rise in cigarette consumption during the early-to-mid 20th Century; peaking from the mid-to-latter half of the Century; before entering into a steep decline in the 1990s.

In the United States, for example, the Federal Trade Commission (FTC) reported that the tobacco industry experienced an annual downward trend in sales since 2000, when sales volume to wholesalers and retailers were at 413.9 billion cigarettes, before dropping 202.9 billion in 2019.[6] FTC data indicate that smokeless tobacco sales also decreased from 128.4 million pounds in 2018 to 126.0 million pounds in 2019. From January 26, 2020, to December 26, 2021, annual cigarette pack sales decreased by 7.6 percent (9.8 billion to 9.1 billion packs); dollar sales decreased by 1.4 percent (US$66.5 billion to US$65.6 billion).[7] Data for the second quarter of 2022, confirm this downtrend for tobacco companies, as the rising gas prices and inflation continue to pressure tobacco consumers' disposable income, resulting in a decline of total tobacco industry volumes of 7.5 percent.[8]

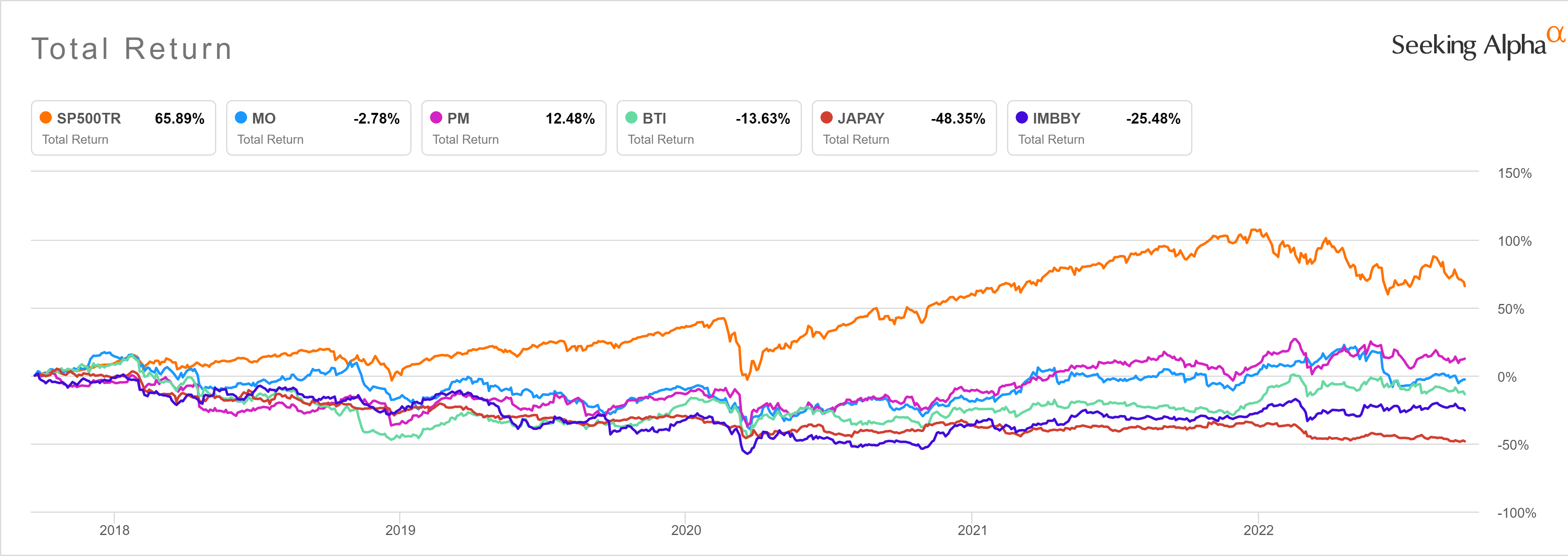

As shown in the Figure below, an assessment of the comparative total return[9] of Big Tobacco companies vs S&P500 companies[10] for the past five years to 2022, indicates that with the exception of one company, the tobacco industry had a negative performance while the S&P500 companies were up over 65.89 percent.

2. Tobacco Industry’s Search for a New Business Model

The product diversification taking place in the tobacco industry is no surprise. Tobacco companies are planning for a business structure which can remain profitable, despite the decline in popularity of their primary product—cigarettes, particularly in high-income markets.[11] Faced with steadily declining cigarette sales, tobacco companies now aggressively promote e-cigarettes,[12] which are designed to sustain nicotine addiction[13] among customers and recruit new users who will discover that cigarettes are hard to quit. There are also direct-to-consumer marketing campaigns for other tobacco products--for example, promotion of flavored nicotine formulas through so-called influencers on Facebook, Twitter and other social media sites, targeting the youth,[14] and online sales of chewing tobacco. The industry has even ridden the organic wave—some products are described as “natural”, “additive free” and made with organic tobacco.[15] Tobacco industry companies are also starting to venture into the pharmaceutical industry in their drive to diversify product lines.[16] For example, Philip Morris International (PMI), the US-based company, purchased in 2021 the respiratory drug developer OtiTopic, that is currently working on Asprihale, a late-stage inhalable acetylsalicylic acid (ASA) treatment for acute myocardial infarction. Also, PMI acquired in 2021 Vectura, a pharmaceutical group manufacturing medical devices to treat chronic obstructive pulmonary disease (COPD) and whose technology allows more medicines to be inhaled.[17]

3. The Business of Cigarettes Is STILL the Big Money Maker for the Tobacco Industry

With the decline of cigarette smoking in high-income countries, the demand for this product has shifted to low-and-middle-income countries . This trend that has been facilitated by population growth, rising per capita income levels, changing life styles, lenient government regulations, and low tobacco taxes. The expanding global exposure has helped the tobacco industry offset lower demand and declining sales of cigarettes in high-income countries, enabling the industry to continue earnings growth (for example, in 2021, there was a significant rise in cigarette sales to above pre-pandemic levels in the Middle-East and Africa[18]). Since the launch of the “unsmoke” campaign alone[19], data reported by PMI for the fourth quarter of 2021 showed that cigarette and heated tobacco unit shipment volume went up by 4.2 percent (reflecting cigarette shipment volume up by 2.4 percent, and heated tobacco unit shipment volume up by 17.0 percent to 25.4 billion units).[20] The global tobacco market size was valued at US$849.9 billion in 2021, and cigarettes captured the majority share of the market, accounting for nearly 86 percent of the overall revenue.[21]

4. The Damage Tobacco Continues to Wreak on Health and the Environment

Cigarette smoking is causally linked to diseases of nearly all organs of the body.[22] Globally in 2019, it accounted for about 8 million deaths and 200 million disability-adjusted life-years (DALYS).[23]

The enormity of lives lost from tobacco-attributable diseases is better appreciated when compared to the tragic 6.5 million COVID-19 deaths that have been recorded to date since the beginning of the pandemic in early 2020.[24] And, country evidence from China, Italy, and other countries suggests that smokers have higher odds of progression in COVID-19 severity and death compared to non-smokers.[25]

Although e-cigarettes are promoted as “reduced risk” and “smoke-free” consumer products to protect smokers from the ill effects of cigarettes, their emissions typically contain toxic substances that are harmful to users and to non-users who are exposed to the aerosols second-hand.[26] A comprehensive review of evidence done by US Surgeon General in 2016[27] concluded that tobacco use among youth and young adults in any form, including e-cigarettes, is not safe, and that in recent years, e-cigarette use by youth and young adults has increased at an alarming rate (e.g., the sales of fruit and other flavored e-cigarette cartridges preferred by youth increased seven-fold over 2015-2018[28]), and nicotine concentrations in disposable e-cigarette products also increased. The report warned that since e-cigarettes are tobacco products that deliver nicotine, which is a highly addictive and toxic substance, they may pose the risk that many of today’s youth who are using e-cigarettes could become tomorrow’s cigarette smokers to continue to feed their nicotine addiction.[29] The announcement by Connecticut and 34 states and territories in the United States on September 6, 2022, in reaching a landmark US$438.5 million agreement with JUUL Labs (until recently, the dominant player in the vaping market) that will end its advertising campaigns that relentlessly marketed vaping products to underage youth, manipulated their chemical composition to be palatable to inexperienced users, employed an inadequate age verification process, and misled consumers about the nicotine content and addictiveness of its products, validates this warning.[30]

Onerous Economic Costs. Smoking-related illness also costs billions of dollars each year, imposing a heavy economic toll on countries, both in terms of direct medical care costs and lost productivity. Globally, the total economic cost of smoking is estimated to be more than US$1.4 trillion per year, equivalent to 1.8 percent of the world’s annual Gross Domestic Product (GDP).[31] In the case of the United States, for example, cigarette smoking cost more than US$600 billion in 2018, including: more than US$240 billion in healthcare spending; nearly US$185 billion in lost productivity from smoking-related illnesses and health conditions; nearly US$180 billion in lost productivity from smoking-related premature death; and US$7 billion in lost productivity from premature death from secondhand smoke exposure.[32]

While the devastating public health consequences of tobacco use are widely understood and documented, few people appreciate that tobacco also has profoundly negative environmental impacts.[33] [34] Cigarette butts are the world’s most frequently littered item, with estimates that more than five trillion butts are discarded each year, ending up on beaches and in waterways. Tobacco filters – made of cellulose acetate - are the number one ocean plastic, more numerous than plastic bottles, plastic bags, or plastic straws. Cigarette butts pollute water ways where they dissipate into microplastics and enter the food chain. They also leach a dangerous suite of chemicals that place water quality at risk-- one cigarette butt can pollute 1,000 L of water.[35] Disposing of e-cigarette waste is a growing problem, especially given the rise of single-use and disposable e-cigarettes cartridges, that contain plastic, electronic and chemical waste.[36] Additionally, 2 million tons of packaging waste is created yearly. Tobacco farming is highly water intensive (22 billion tons of water are estimated to be used in tobacco production globally), contributes to biodiversity loss, and causes 5 percent of deforestation in low- and middle-income countries, due to land clearing to grow the crops and procure wood for tobacco curing.

Tobacco cultivation and manufacturing, as well as tobacco smoke, contribute many toxic substances that are released directly into the environment. Estimates done by researchers at the Centre for Environmental Policy, Imperial College London, [37] indicate that the cultivation of 32.4 metric tons (MT, equal to 1000 kilograms) of green tobacco used for the production of 6.48 MT of dry tobacco in the six trillion cigarettes manufactured worldwide in 2014, contributed almost 84 MT of carbon dioxide (CO2), one of the greenhouse gases responsible for global warming (approximately 0.2 percent of the global total of CO2 emissions). It also contributed 490 000 MT of 1,4-dichlorobenzene (an organic compound), and over 22 billion cubic meters and 21 MT of oil, to water and fossil fuel depletion, respectively.

5. Is a Tobacco Endgame Possible?

Ending the tobacco use pandemic is a defining challenge in global public health post-COVID-19 pandemic. Tobacco production and consumption are incompatible with the achievement of the United Nations Sustainable Development Goals (SDGs), negatively impacting 14 of the 17 SDGs.[38]

Innovative strategies[39] must be supported and advanced to put the public interest first. The Tobacco-Free Finance Pledge[40], a global initiative with a mission to inform, prioritize, and advance tobacco-free finance with the end goal being a world free from tobacco, is a promising and innovative approach. The Pledge has been signed by almost 200 investors globally, representing over US$16 trillion in assets under management.

As noted by Gail Hurley in a recent editorial[41], finance sector actors wield enormous power worldwide with their investment, lending, and insurance decisions. Pension funds alone held over US$35 trillion in assets at the end of 2020. Globally, the insurance market generated total gross written premiums of US$5.8 trillion in 2020, with 53 percent in non-life sectors. The decisions these investors make can help drive finance to SDGs-friendly economic activities and projects. Indeed, many finance sector actors have made public commitments to support the SDGs, as expressed by their participation in important international initiatives like the UN Global Compact, Global Investors for Sustainable Development (GISD), and the UN Principles for Responsible Investment (as well as more recently the Principles for Responsible Banking and Insurance). Interest in investing ‘responsibly’ and ‘sustainably’ has increased significantly over recent years. At the same time, there are many banks, pension funds, insurance providers and other finance sector actors that continue to lend to, invest in, and insure tobacco companies, despite their promises to support the SDGs.

The World Bank Group (WBG), one of the largest sources of funding and knowledge for developing countries, offers a good example to other international agencies and private firms on how to confront the development threat posed by tobacco use. The unambiguous Operational Directive 4.76 of 1999 mandates that the WBG does not lend directly to tobacco production, processing, or marketing; provide grants for investment in these activities; or guarantee investments, loans, or credits for these industries.[42]

More can be done to inform both institutional, passive investors, and active asset managers about the real economic cost of tobacco use globally, that far outweigh the financial returns. Also, it is worth highlighting that tobacco investments have increased potential for becoming ‘stranded assets’, if governments around the world continue to discourage tobacco use further in accordance with the WHO Framework Convention on Tobacco Control (FCTC),[43] and investors ditch stocks over Environmental, Social, Governance (ESG) concerns.[44] Considering the opportunity cost of capital, investors can still earn an equity premium without investing in tobacco stocks and risking reputational damage[45], or to be involved in multi-million legal disputes. This realization would help reduce the attractiveness of the investing in the tobacco industry.

Changing the profit story of the tobacco industry therefore represent a game-changing possibility for tobacco control, as fully informed investors “voting with their wallets” will move towards tobacco free investments avoiding an industry that harms its customers, while contributing to the achievement of Net Zero environmental targets.[46] [47]

Moving forward, as David Malpass, President of the World Bank Group, recently observed, “more than two years into the COVID crisis, it is devastatingly clear that broad-based participation in global public goods is necessary, whether for climate change, COVID-19 vaccines, refugees, or future pandemic prevention and preparedness.”[48] Indeed, massive and complex challenges such as raising the healthy life expectancy of the population and climate change require global solidarity and action, and there is no place for tobacco in a post-pandemic world.

References