Bloomberg Task Force on Fiscal Policy for Health Taxing for Health: A Global Call to Save Lives and Boost Economies

Patricio V Marquez

Reflecting on my 30+ years at the World Bank Group before retiring, one of my proudest contributions to advancing the global public health agenda was supporting countries worldwide in designing and implementing a critical policy: raising tobacco taxes. This measure can simultaneously save millions of lives, reduce poverty, and increase countries’ domestic resources for financing development. Additionally, it enhanced equity and contributed to environmental protection.

Now, as the world navigates the turbulent post-pandemic era—characterized by multiple concurrent crises, tensions and conflict, sluggish economic performance, rising debt, and diminished fiscal capacity to meet basic population needs—it is time to renew and strengthen the call for governments to increase taxes on tobacco, alcohol, and sugary beverages. This policy measure is backed by a solid economic rationale and robust evidence from countries worldwide.

The new report from the Bloomberg Task Force on Fiscal Policy for Health released in New York City today in time for the United Nations General Assembly, brings out fresh evidence that this policy measure indeed works. The findings in the report not only bring the hopeful message of ‘si se puede’ (yes, we can), but it shows that it is a win-win-win-win policy that delivers on many fronts.

Here I summarize the main messages of the report:

- Urgent Action Needed to Reduce Deaths and Disease from Harmful Consumption

Tobacco, alcohol, and sugary beverages contribute significantly to global mortality and economic burdens, particularly in low- and middle-income countries. Each year, these products cause over 10 million deaths worldwide and incur economic costs exceeding $4 trillion. Immediate action is essential to prevent unnecessary loss of life.

- Health Taxes: A Timely and Effective Policy Solution

Health taxes on tobacco, alcohol, and sugary beverages offer a unique solution to today's health and fiscal crises. These taxes not only improve public health but also generate substantial revenue that can alleviate financial pressures without compromising economic growth. Despite this, progress on implementing these taxes has stalled, especially for tobacco and alcohol.

- Raising and Reforming Tobacco Taxes Should Be the Highest Priority

Tobacco remains the leading cause of preventable death and illness among the three products discussed. Effective tax policies are well-documented, yet tobacco taxes have regressed in many countries. Currently, 87 percent of the world's smokers live in places where cigarettes are as affordable, if not more, than in 2019, highlighting the urgent need for tax reform.

- Decisive Action on Health Taxes Can Save Millions of Lives

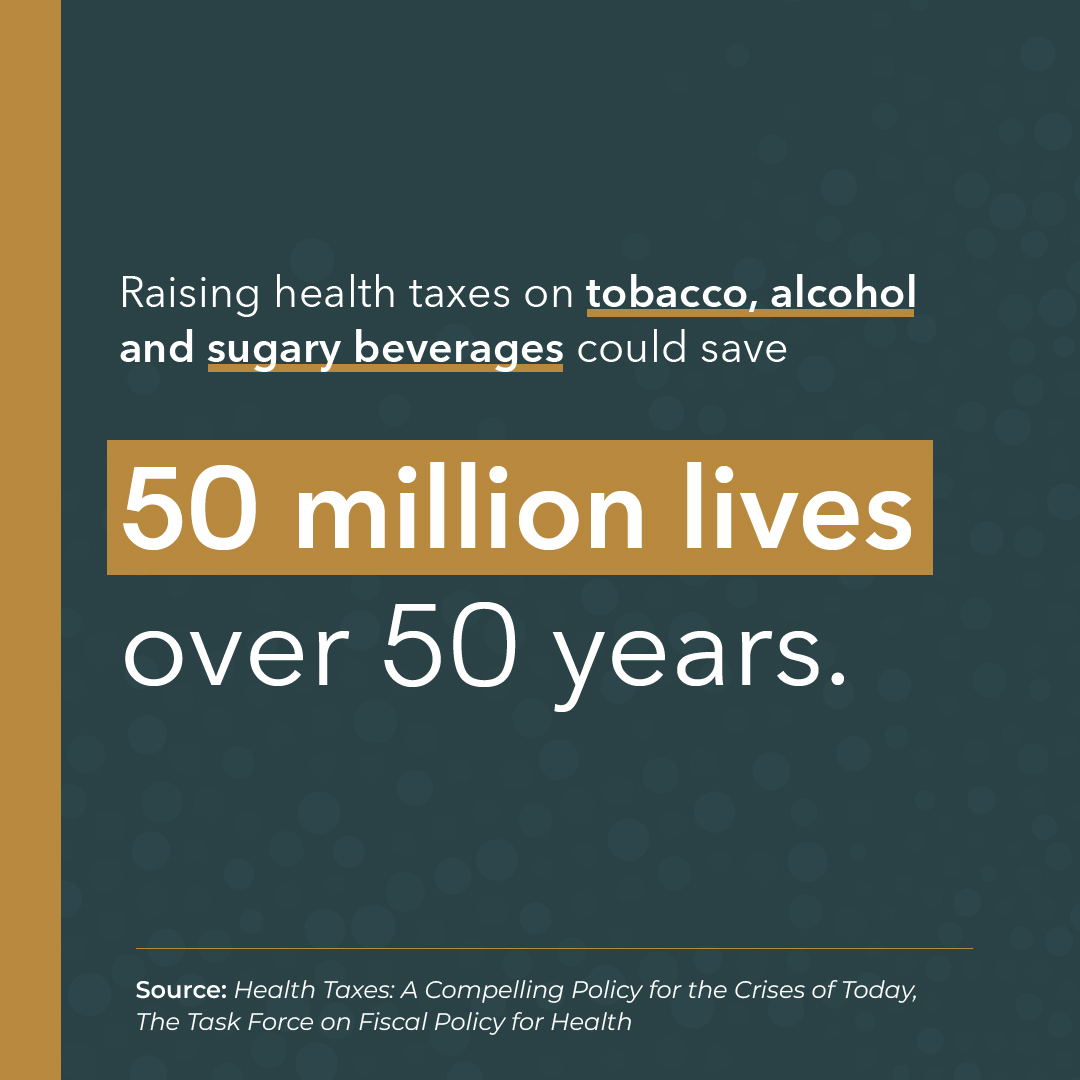

Implementing taxes that result in a 50 percent price increase for tobacco, alcohol, and sugary beverages could save 50 million lives over 50 years and raise $3.7 trillion globally in just five years, including $2.1 trillion in LMICs. Redirecting these funds to healthcare could increase global health spending by 12 percent, and by 40 percent in LMICs, offering a substantial boost to health systems.

- Call for Global Commitment to Substantially Increase Health Taxes

Governments worldwide must urgently increase health taxes on tobacco, alcohol, and sugary beverages, ensuring they grow faster than inflation and economic growth. This will require overcoming industry resistance and leveraging public support. Multilateral agencies should actively support these efforts to secure a win-win outcome for public health and government revenues.

Looking Forward

Anna Bjerde, Managing Director of the World Bank Group, has emphasizes that “the way we respond to development challenges matters.” In these challenging times, countries must be laser-focused on maximizing impact at scale. Governments need to act boldly, pushing past the objections of those prioritizing short-term individual interests over effective policy that benefit all. This is particularly urgent as World Bank Group estimates suggest that in 2024-2025, economic growth is projected to underperform the 2010s average in nearly 60 percent of economies, covering over 80 percent of the global population. Downside risks, such as geopolitical tensions, trade fragmentation, prolonged high interest rates, and climate-related disasters, and I may add, rapid aging of the population and growing health care needs, dominate the landscape.

Raising taxes on tobacco, alcohol, and sugary beverages stands out as a straightforward yet highly effective strategy. This measure not only improves public health, saves lives, and protects the environment but also broadens the tax base, generating additional public revenue without hindering economic performance. It represents a vital investment in building human capital and securing the long-term wealth and prosperity of all. Now, more than ever, taxing for health not only makes sense, but it is essential

Source of Images:

First image: photo taken by author of Volcan Fuego, Guatemala City, September 23, 2024.

Second image: graph from the Bloomberg Task Force on Fiscal Policy for Health.